At its Show Time keynote, Apple announced Apple Card, its credit card offering, in partnership with Goldman Sachs and Mastercard. Make no mistake. Apple’s fintech move is significant. The Apple Card strategy is to lure millennials away from traditional credit card play, to new, exciting experiences in financial services, delivered on iPhone apps.

Some key questions abound:

Why is Apple serious about fintech?

How does one look at the Apple Card?

And, what incentives are there for consumer to seek Apple Card?

Apple and Payments

First, here is how far Apple has come on payments.

Apple Pay, Apple’s mobile wallet payment service, was launched five years ago, and is now accepted by 70% of the merchants in US. As per some estimates, Apple Pay will see 10 Bn transactions on its platform this year.

Apple Card: The Next Logical Move for Apple

At its Keynote, Apple introduced five new service offerings. Most of the new offerings were iterative in nature, with some incremental value-additions. In sharp contrast, Apple Card stood out for its wow factor.

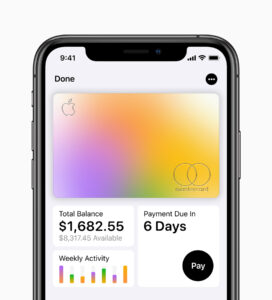

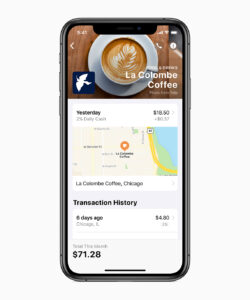

Apple Card is built into the Apple Wallet app on iPhone, offering customers a familiar experience with Apple Pay and the ability to manage their card right on iPhone. As things stand, Apple Card simplifies the card application process, eliminating fees, with less credit card interest and heightened privacy and security features. Beyond the digital Apple Card, Apple has also introduced a sleek titanium credit card issued to members in partnership with Mastercard. Users can use this physical credit card to shop at locations where Apple Pay is not accepted yet.

Apple Card: X-Factor

For today’s millennials, the Apple Card’s key features would be a key pull-factor. In addition, the Apple Card would appeal to the mass installed user base of Apple. Its partnership with Goldman Sachs could potentially be a win-win for both parties, with good value addition driving the business. Goldman Sachs aims to move beyond its legacy business and offer more lending through credit cards. It helps that the Apple fan base would also be keen on trying this new Card.

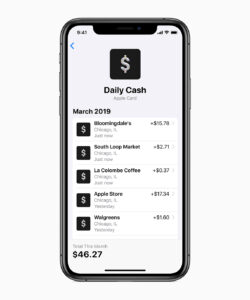

In terms of rewards, the offerings from Apple are similar to what other cards  already offer. Apple is promising daily cash pay-outs into the Apple Cash card. However, where Apple’s credit card differs from others is in doing away with the credit card numbers itself. This is a move that, in turn, could spur other ecosystem players to also embrace. Given the

already offer. Apple is promising daily cash pay-outs into the Apple Cash card. However, where Apple’s credit card differs from others is in doing away with the credit card numbers itself. This is a move that, in turn, could spur other ecosystem players to also embrace. Given the

All said, through the Apple Card, Apple is intent on monetizing its large customer base, and drive more revenues per user.

That said, who will the users of Apple Card?

The ease of Apple Card usage may drive more iPhone-wielding millennials to spend more within Apple’s walled garden, and via its card at other locations. The Apple Card would appeal to millennials, more than others. Given Apple’s emphasis on privacy, security and its simplified approach in its Apple Card, iPhone users would be keen on giving it a try.

The ease of Apple Card usage may drive more iPhone-wielding millennials to spend more within Apple’s walled garden, and via its card at other locations. The Apple Card would appeal to millennials, more than others. Given Apple’s emphasis on privacy, security and its simplified approach in its Apple Card, iPhone users would be keen on giving it a try.

Users outside of Apple’s walled garden, or those who choose not to go ahead with the Apple Card, should also be tempted to stand-up and take note of Apple’s latest move.

In Conclusion

What Apple has set in motion is to re-envision fintech. Sooner than later, other fintech players would have to respond to Apple’s new offering with their own, competitive services.

Apple Card will arrive this summer.

In case you missed the Keynote, here is a note on all the major announcements made by Apple.

Get WordPress help, plugins, themes and tips at MachoThemes.com