COVID-19 has disrupted global supply chains causing supply bottlenecks and sending shockwaves everywhere. Alongside, falling consumer demand due to lockdowns pose a threat, and increasing the risk of a unending downward spiral and unending uncertainties. So, how did FAAMG face upto the COVID-19 threat?

The “FAAMG” Five—Facebook, Amazon, Apple, Microsoft, and Alphabet (Google) have a combined market capitalization of over $4.7Tn. The “FAAMG” basket accounts for 18% of the total S&P 500 value.

Let’s talk about COVID-19 first.

In December 2019, the first case of a novel coronavirus outbreak emerged in Wuhan, China. Health authorities in China confirmed that dozens of people in Wuhan, China, were being treated for pneumonia from an unknown source. The first death due to COVID-19 was reported in early January. In mid-January 2020, China imposed aggressive containment measures in Wuhan, the epicentre of the outbreak, suspending flights and trains and shutting down subways, buses and ferries in an attempt to stem the spread of the virus. Since then, the virus has spread to more than 200 countries and territories globally, with new cases rapidly increasing across geographies. On Jan 30, 2020, WHO declared the outbreak a global public health emergency as more than 9,000 cases were reported worldwide, including in 18 countries beyond China.

On April 26, 2020, the total COVID-19 confirmed cases worldwide stood at 32,71,961, with 233,704 reported deaths.

In late February 2020, COVID-19 hit the American shores and disrupted the world’s largest consumer market. Within a few days, consumer’s purchasing plans and spending habits changed significantly.

A comprehensive review of Q1 results of the FAAMG shows companies started facing some heat towards the end of Quarter, and anticipated to face upto the full brunt of COVID-19 in Q2 2020. Q2 2020, in all probability, will be the COVID Quarter.

The COVID-19 pandemic is having a broad impact on FB’s metrics, revenue, expenses and business operations. As people stayed homebound, there was increased engagement online globally.

FB’s revenue remained strong through the quarter until the first week of March. However, thereafter, FB experienced a steep fall in its ad revenues, as countries started implementing lockdown measures.

While COVID-19 had an impact across the globe in Q1, the ad revenue growth was strongest in Asia Pacific at 21%, followed by US, Canada, Europe and Rest of World at 16% each.

Amazon

Amazon typically experiences a spike in demand during this time of the year, ramping-up for events such as the Prime Day. The onset of COVID-19 did not provide Amazon with any avenues for preparation. During the crisis, Amazon saw a drop in travel and entertainment, as well as in the demand for non-essential items. Grocery saw a spike. As a consequence, Amazon increased grocery delivery capacity by more than 60% and expanded in-store pickup at Whole Foods stores from 80 stores to more than 150 stores.

As Amazon faced increased demand, it hired an additional 175,000 new employees. Amazon took steps to dampen demand for non-essential products including reducing our marketing spend. Its network pivoted to shipping priority products within one to four days.

Amazon has invested more than $600Mn in COVID-related costs in Q1 and expect these costs could grow to $4 billion or more in Q2.

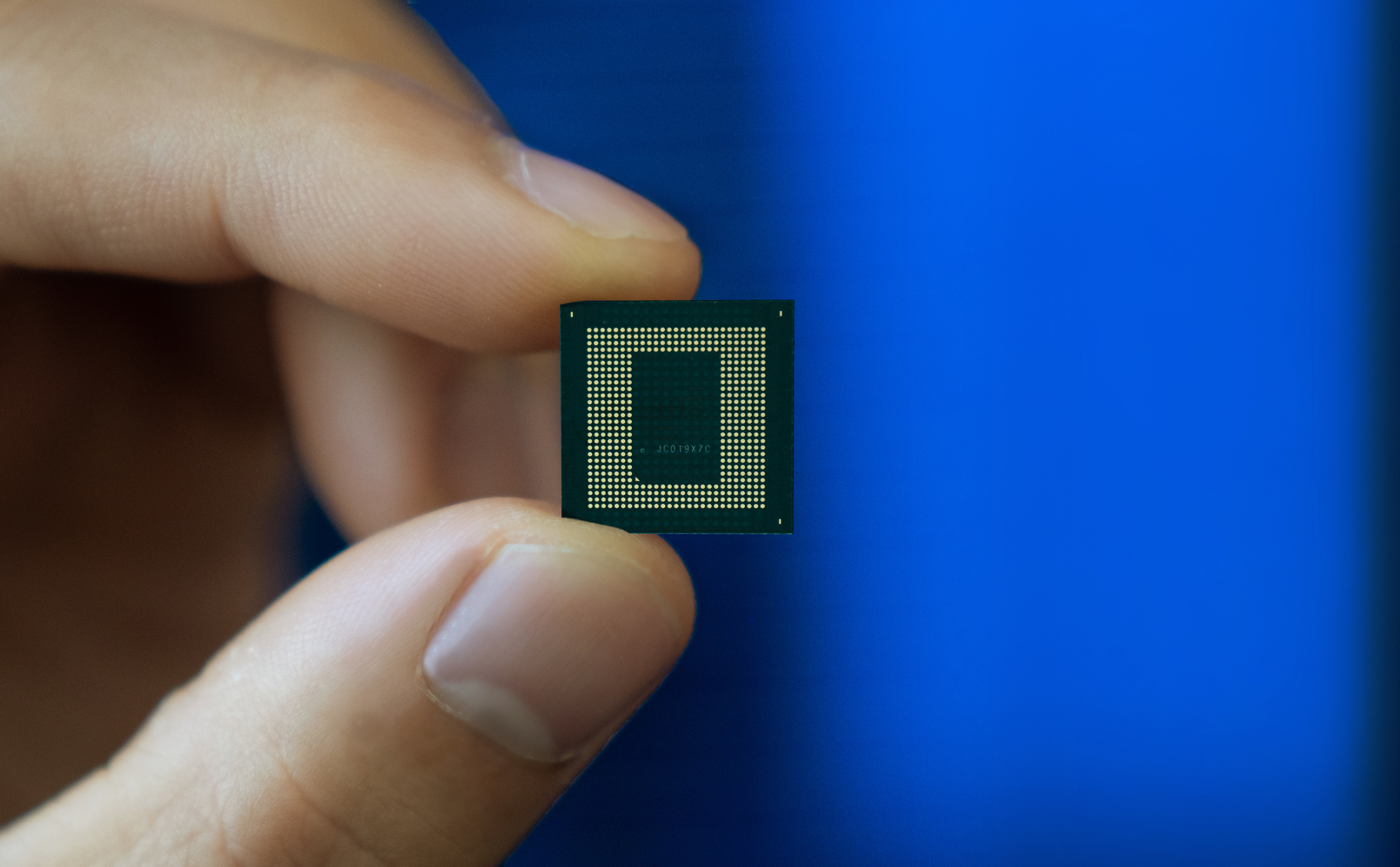

Apple

For Apple, the supply and demand of iPhones was temporarily affected, with the onset of COVID-19 in China. During this initial period, demand outside of China remained strong. During the last three weeks of the quarter, the virus spread globally and social distancing measures were put in place worldwide. This led to the closure of all retail stores outside of China on March 13. As a consequence, Apple saw a downward pressure on demand particularly for iPhone and Wearables. Apple iPhone revenue of $29Bn declined 7% year-over-year as both iPhone supply and demand were affected by the impact of COVID-19 at some point during the quarter.

For Apple, the supply and demand of iPhones was temporarily affected, with the onset of COVID-19 in China. During this initial period, demand outside of China remained strong. During the last three weeks of the quarter, the virus spread globally and social distancing measures were put in place worldwide. This led to the closure of all retail stores outside of China on March 13. As a consequence, Apple saw a downward pressure on demand particularly for iPhone and Wearables. Apple iPhone revenue of $29Bn declined 7% year-over-year as both iPhone supply and demand were affected by the impact of COVID-19 at some point during the quarter.

While Apple believes the supply chain in China continues to be resilient and jumped back swiftly from the shocks, it will look into the COVID-19 impact and learnings once it moves beyond the current crisis.

Microsoft

As a consequence of homebound economy with increasing number of people working from home, Microsoft saw increased demand, benefiting its Windows OEM, Surface, Office Consumer, and Gaming. On the other hand, Microsoft’s advertising spend got impacted, especially in Search and LinkedIn businesses. In addition, there was a slowdown in Microsoft’s transactional business especially in small and medium business segment. In Enterprise Services, growth rates slowed as consulting projects were delayed.

For Google’s advertising business, the first two months of the quarter were strong. In March, there was a significant and abrupt slowdown in ad revenues, as nations started enforcing stay-at-home orders. The timing of the slowdown correlated to the locations and sectors impacted by the virus and related shutdown orders. Google delayed some ad launches and prioritized supporting its customer base in the wake of COVID-19. Beyond advertising, other revenue lines, including Google Cloud, continued to maintain their strong performance. Compared to other geographies, Google saw comparatively lesser decline in APAC. It was probably due to the uneven impact of COVID in the region.

For Google’s advertising business, the first two months of the quarter were strong. In March, there was a significant and abrupt slowdown in ad revenues, as nations started enforcing stay-at-home orders. The timing of the slowdown correlated to the locations and sectors impacted by the virus and related shutdown orders. Google delayed some ad launches and prioritized supporting its customer base in the wake of COVID-19. Beyond advertising, other revenue lines, including Google Cloud, continued to maintain their strong performance. Compared to other geographies, Google saw comparatively lesser decline in APAC. It was probably due to the uneven impact of COVID in the region.

Future Forward

It will be interesting to see how COVID-19 impacts FAAMG in the upcoming quarter. This is the period when lockdowns were enforced, and nations were in lockdown.